How Should Your Association Think About Reserves?

How does an association know when to invest or how much to invest? While there is no one right answer for all associations with respect to when, or how much to invest, once a certain amount of excess operating funds has been saved, the organization may start to wonder what should be done with these funds. Excess funds could serve as a lifeline during a budget shortfall, fund a new initiative or program, or ensure the future viability of the association. Before being able to decide how to invest these funds, the organization should determine their purpose. Once the purpose of the funds has been decided, creating some type of investment strategy will make sense. Each organization is unique and should determine what will work best for their needs.

Establish a Reserve Policy

The first step is determining what the appropriate amount is for a reserve portfolio. A variety of factors can drive what that amount should be. If your organization’s revenue streams are diversified, income is relatively reliable, or costs can be cut quickly, then it’s likely you will not need to hold as much in reserve. However, if your organization has few revenue sources, income that fluctuates significantly year-to-year, or it will take time to cut costs, it’s likely more will be needed to be held in reserve. In addition, if there are strategic initiatives that your organization wants to pursue and they are not budgeted for, your organization will need even more in reserve.

To quantify the dollars needed in reserve we recommend going through a risk and opportunity assessment. After identifying all potential risks and opportunities, discount them based on the likelihood or time frame over which they may occur. A dollar value, or range of potential values, can then be assigned to each item to determine the total dollar amount or range to hold in reserve.

The process and its outcome should be outlined in a reserve policy with a risk/opportunity assessment included as documentation. With the new reserve target or range it’s important to outline which actions to take to either add to the reserve, or whether to consider a spending plan. This assessment should be revisited every few years to determine if there have been any changes to your organization’s risks or opportunities.

Short-Term Investments

After determining a reserve policy and segmenting assets, the short-term reserve investments will be focused on capital preservation and mitigating risk.

Organizations looking to make the best use of short-term assets can mitigate risk in three different ways:

- Using FDIC insured products or accounts (CDs and bank money market or savings accounts)

- Buying bonds backed by the U.S. Treasury or other U.S. government agencies

- Having diversified funds that invest in high quality government or corporate bonds (fixed income mutual funds)

If the timing is clear that cash will be spent several years out, it’s highly efficient to use individual CDs or government bonds that mature near when the funds are needed. If there is no specific timing for withdrawals, we recommend using low-cost bond mutual funds that will exist in perpetuity. We suggest targeting a certain short-term average maturity that’s in line with the potential timing of withdrawals. The average credit quality should be very high (AA or higher) so it’s less likely that the portfolio would be down notably when funds are needed for withdrawal. As the time frame expands beyond two or three years, having a small allocation (15 – 30%) to equity could provide additional diversification for the portfolio.

Given that the purpose of the reserve is to cover a future cash outflow, we recommend that these investments be very liquid so that they can be quickly exited when it becomes necessary to make an outlay.

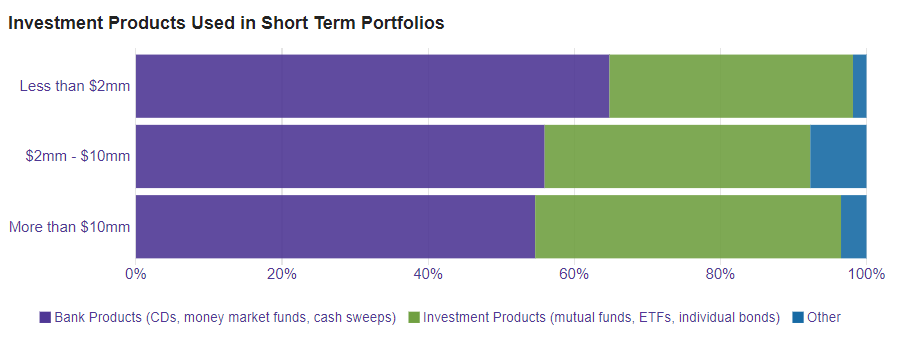

Citation for the graph: 2019 Study on Nonprofit Results (SONI)

The graph above is from the 2019 Study on Nonprofit Investing report. The graph is a visual representation of the investment products utilized in different organization’s short term portfolios. The organization’s responses are segmented by the budget size of the organization (less than $2 million, $2 million to $10 million, or more than $10 million).

SONI is a peer benchmarking survey of nonprofits, surveying finance executives from associations, public charities, and private foundations. Now in its seventh year, SONI has over 2,000 participants. The data is segmented by budget size, which makes it much easier for an association to see if its investment policies, fees, and returns are in line with those of similar organizations.

Disclosures

The views expressed herein are opinions reflecting the best professional judgment of Raffa Wealth Management, LLC. This article is for informational purposes only. The information contained has been gathered from sources we believe to be reliable, but we do not guarantee the accuracy or completeness of such information. Data analysis was performed by Raffa Wealth Management. When stating “nonprofit” or “association” responses it should be noted that all responses are limited to the nonprofits that participated in the survey. No broader indications should be assumed. There can be no assurance that the future performance of any specific investment or investment strategy referenced in this article will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your nonprofit’s portfolio. Any investment can lose value.

Survey participant responses, including investment performance, have not been verified or audited. All performance data cited is as of 12/31/2018 or SONI 2019. Past performance is not an indication of future results and any investment can lose value.