When you think about donations, cash always comes to mind first. There are thousands of donation buttons online for corporations and non-profit organizations on the internet. However, cash or money is not the only kind of donation someone could make. Another option is something called an in-kind donation, which means providing valuable services and goods for free. In-kind donations are great and even vital for many organizations. This post will give a detailed guide on what in-kind donations are, how they can help you, and how to get them in 3 steps.

What is an in-kind donation?

In-kind donations are the type of donations where, instead of giving money, you provide the necessary products and services themselves for free. These could be providing a rental space, a web server, toys, or anything else that might be valuable for your organization or campaign. In that regard, big companies and corporations are perhaps the major sources of in-kind donations for non-profit organizations.

NGOs can save these in-kind donations to their annual financial reports as the donation’s real value. For example, if an animal shelter is collecting donations worth 10.000 USD in order to buy pet food, a company could donate the pet food itself as a donation instead of giving money. Some organizations collect books, toys, or clothes for those in need and it is a great way to help others. The most common type of in-kind donations is free services and properties. A teacher giving free lectures and a designer providing free organizational designs and images are also perfect examples.

Pro tip: Always specify what you need. You don’t want to end up with useless donations.

Types of In-Kind Donations

Basically, an in-kind donation is any donation that your nonprofit gets that is not monetary in nature (cash, stocks, bequests, etc.). As a result, the definition of in-kind gifts is fairly broad.

Properties, intangible assets (copyrights, patents, intellectual property), services, and rent-free space are all examples of in-kind donations. You are most likely dealing with an in-kind contribution whenever someone gives anything or offers their expertise in the field. Sometimes copyrights and intellectual property can be donated in kind, such as when an artist gives you permission to play their song without paying a fee.

Why are in-kind donations important?

Nonprofits can use in-kind gifts to get items and services that are often out of reach or to free up resources to spend on another one. Considering a church collecting money for providing free access to food, it could use in-kind meals and spend the money on providing housing. When a company is giving in-kind donations that they do not charge for is actually profitable for them. As businesses shouldn’t have to be concerned about their revenue, in-kind donations are typically a more convenient way for businesses to give. Furthermore, considering firms usually pay less for commodities, they can contribute more in goods rather than cash. Some donors could use this as an opportunity for marketing as well. A clothing company could donate T-shirts and this action can take space in media, branded materials will also create awareness.

Benefits of In-Kind Donations

In-kind gifts enable charitable organizations to use products and services that would otherwise be out of reach financially or free up funds to be used elsewhere.

Businesses frequently find it easier to donate in kind. When making these judgments, they frequently don’t have to take their budget or cash flow into account as much. There may occasionally be extra or unsold merchandise available. Businesses may also have purchased things at a lower cost than they are now selling them for, allowing them to contribute more stuff than they could in cash.

Nonprofit organizations can use items and services that they would otherwise have to pay for or that are just out of their price range thanks to in-kind gifts. Donations in kind can come with a lot of benefits:

- A successful strategy to attract new supporters

- A strategy for creating enduring commercial relationships

- Reduce the deficit

- Reduce waste since companies may donate unsold inventory or other items.

- Businesses may donate more easily since they don’t have to worry about financial flow

Are in-kind gifts eligible for tax deductions?

Although their tax advisors should be consulted, your supporters may be able to deduct their in-kind contributions from their taxes.

An in-kind (or non-cash) donation may be written off by the contributor as a charitable contribution. In addition, a donor needs a formal acknowledgment from the organization to prove their donation, however usually no financial amount is given in the acknowledgment.

How to record an in-kind donation?

Several elements determine how your organization must keep track of and record in-kind contributions. All in-kind donations must be recorded and reported in your financial records if your organization follows generally accepted accounting principles (GAAP) while preparing its financial statements.

This criterion must also be met by organizations that are subject to an annual audit by an independent accountant; some may be obliged to do so by state law, the terms, and conditions imposed by a lender, grantor, or another significant stakeholder.

As soon as a donor delivers an in-kind gift to the nonprofit, it should be documented, and depending on volume, it may be done more regularly. They should be documented yearly.

Get in-kind donations in 3 steps

Step 1: Create a policy

In-kind donations can be a great donation option; however, it also causes some nonprofit organizations to suffer from useless donations. For example, if you are running a health-based organization, you don’t want to collect free chocolate.

This has a very simple solution: To create a clear policy for your nonprofit. Open a document, and start by telling your mission. What is your motive and what do you need? Be very clear. If you’re helping refugees, you can ask for clothing, personal hygiene items, food, and accommodation. Give some clear and valid examples, perhaps from previous in-kind donations that you received that proved to be helpful. Tell them where you’re going to accept donations from, if you need shipment, etc.

You may require a review for certain items like clothing to check if they are in good condition, so write down what you can accept without review. If organizations can donate used items, you can add a guideline on which conditions you are going to accept and you should directly accept new items. Check out Gift Acceptance Policies by Nonprofit Risk Management Center.

Step 2: Create awareness about your organization

You should be accessible on the internet to receive in-kind donations, so creating an online presence is key. If you already have a website, update it with the latest information and details. Add a clear map to your open address. Share your policy on your page. In addition to a website, keep in mind that the best way to create awareness is through social media. Find similar organizations, activists, and individuals willing to help and ask them to share your organization. You can post on Facebook groups, and write comments under popular content. You can also use print media and billboards to attract more people. Put your link and address or add a QR code for your page. Being present could be challenging, so you may also consider asking friends and family to support you along the way.

You can incorporate previous in-kind donations into your online presence as well. It’s beneficial for you to put videos or photos showing your donations and how they are helping the cause. Since possible donors will search for credibility, it is important to provide factual information.

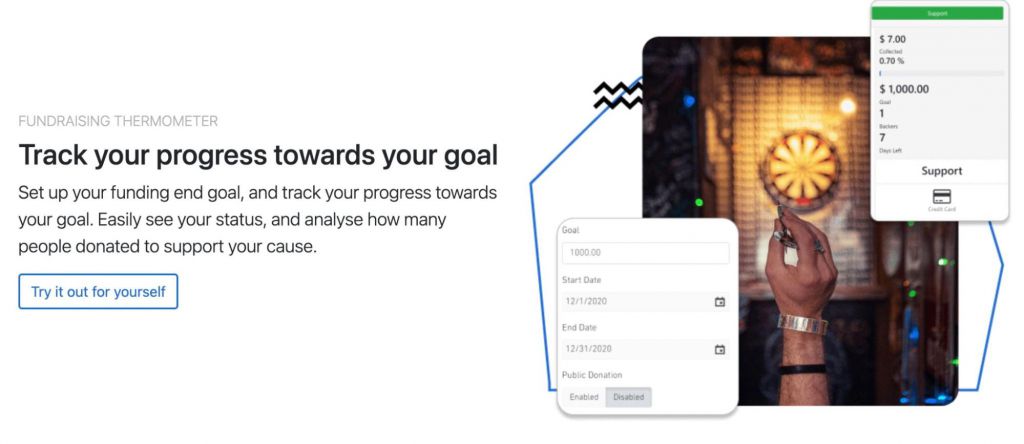

Step 3: Choose a virtual fundraising platform

It is important to save time during your fundraising and donation-collecting processes, which is why you should work with a fundraising platform like Raklet. You can create your own website, domain, and even mobile app. Platforms like these can help you save so much time, money, and effort.

With a fundraising platform, you can maintain your entire workflow in one place easily. You can collect donations on your website, and provide your supporters with the needed information for in-kind donations as well. There are also discussion boards on the platform, which you can use to manage and overview your organization. These might be crucial since you can create content to let people know where you are, so they can follow up easily. Automated emails are another tool that can help you engage with your community by quickly sending briefs weekly, or thank you emails to the donors. Our mobile app could also be useful if your target audience is younger, so they can donate on the go inside the app. Furthermore, you can view your donations in detailed tables. Controlling your finance is crucial for setting up your cash and in-kind donation goals. You can share your progress with your members and donors.

2 Examples of In-Kind Donations

Even after learning what an in-kind gift is, you might still be asking how it could help your organization.

We’ll give you some examples of in-kind donations and discuss their outstanding benefits to charity organizations:

Art and items of value

Donors can also choose to provide rare metals, antiques, or precious stones as donations. A donation in kind may include vehicles like cars and yachts, equity memberships with resale restrictions, shares of privately owned corporations, or eligible restricted, controlled, or lockup stock. Basically, everything can be objectively appraised and has true worth.

Investment products

Stocks, bonds, mutual funds, and segregated funds are examples of publicly traded investment securities. These assets are subject to special regulations that virtually negate any capital gains tax that the donor might otherwise be required to pay. In general, a donor may be required to pay capital gains tax equal to up to 50% of the financial asset’s increased worth. But if the donor decides to give securities to a charity, they will get a contribution receipt for the asset’s fair market value and won’t have to pay capital gains tax on the item they gave away.

Maximize your donations with the best nonprofit software: Raklet!

You can start collecting in-kind donations today with Raklet! We provide an all-in-one solution for your donation and fundraising business. You may create campaigns to raise money for your organization. Create an all-in-one platform with our integrated payment option so that people can give to your campaigns online with ease. Raklet also gives you the ability to expand your business and monitor your progress toward your goal. We hope you have a wonderful start to your donations!

Read more about fundraising and donations on our blog:

- Boost Your Recurring Donations With Raklet!

- How To Start a Fundraiser (Tips & Resources)

- Create an Impact With Our Top 4 Tips for Effective Fundraising for Nonprofits